Integrated Project Risk Quantification

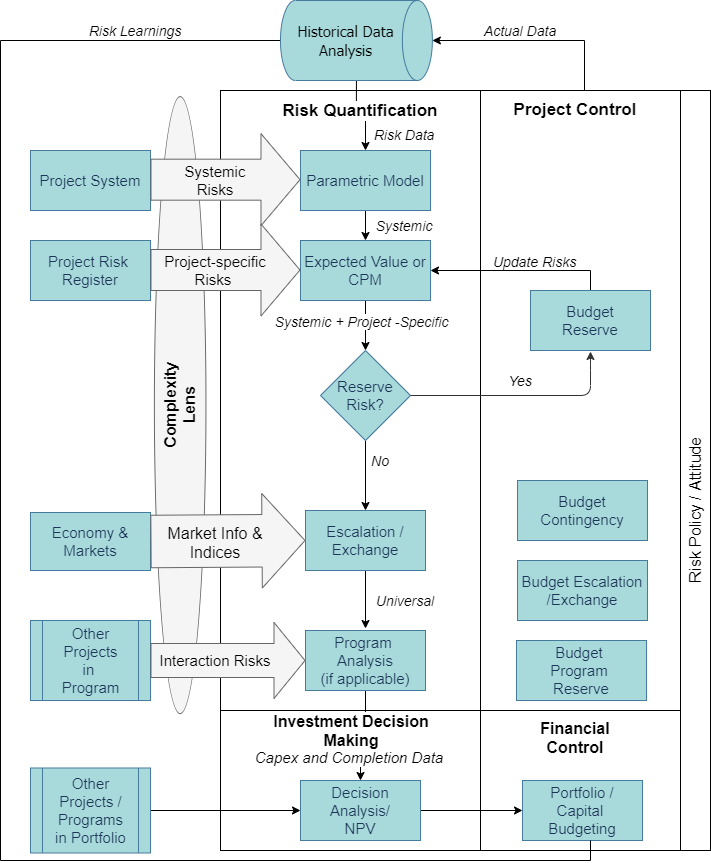

A principle of recommended QRA methods, and integration, is that they include all the risk types (i.e., systemic, project-specific, and escalation) and quantify all the outcomes (i.e., cost and schedule). The risk quantification flowsheet below is from the PRQ book. It illustrates and integrated set of methods to address the various risk types. The ValidRisk tools are aligned to this integrated process.

In respect to risk types, the missing link in most QRA methods is systemic risk. Systemic risks are attributes of the project and project system; they are usually the greatest risk driver (and compound the impact of risk events). Examples are poor scope definition, slow decision making, weak systems, and lack of competencies. QRA methods often ignore these or push them aside as “issues”. The ValidRisk parametric method brings these risks front and center, making sure they are not ignored.

As to cost and schedule integration, research indicates that cost and schedule risk analysis cannot be analyzed separately. This is because the cost and schedule impacts depend in large part on how project management decides to respond to the occurrence of a risk. That decision must consider cost/schedule tradeoffs. Often (but not always), businesses hold firm on the completion date and are willing to sacrifice (trade) cost due to the inordinate impact that late (and therefore more discounted) revenue cash flow has on NPV. However, sometimes cost is king, and schedule may be sacrificed. In the end, there is no natural impact of any risk; there is only the cost and schedule for what we decide to do about it.

This trading behavior is seen in research where cost growth and schedule slip are not highly correlated (e.g., about 0.5 correlation on average) and cost overruns tend to be greater than schedule slip on a percentage basis. Therefore, ValidRisk requires cost and schedule to both be quantified. The good news is that unlike the CPM method (which requires a challenging cost-loaded model), quantifying both cost and schedule takes no real additional effort!

Further, escalation risk (technically speaking, an uncertainty) is often the orphan of the QRA world. Escalation is often the largest cost risk on a project (for example, during the ups and downs of the 2004-2014 commodity super-cycle). To not quantify it as a risk violates core QRA principles. Sadly, finance departments often dictate the use of inflation rates that have little to do with escalation. The ValidEsc tool provides the only industry, probabilistic escalation model on the market. Plus, it incorporates the cost and schedule outputs of the ValidRisk model as drivers of escalation (i.e., escalation is highly sensitive to schedule slip). The ValidEsc model produces a “universal” capex distribution for use as an input to NPV models.